Targeted online ads are the success of 'surveillance capitalism'

June 2022

In 2007, Jonathan Trenn of the US bought a diamond ring from Overstock.com so as to propose to his girlfriend in a few months’ time on New Year’s Eve. Within hours of buying the ring, Trenn received a “shocking call” from a friend saying congratulations for getting engaged.

“Imagine my horror when I learned Overstock.com had published the details of my purchase including a link to the item and its price to all my (Facebook) friends … including my girlfriend and all of her friends,” Trenn said.[1]

Such was the technical ability of Beacon, which Meta Platforms (formerly Facebook) launched in 2007. Beacon’s novelty was it enabled Facebook publisher partners to reveal their customers’ purchases to Facebook networks to drive engagement and sales.

While Beacon was shut down in 2009 due to user complaints about privacy violations, the gathering and commercialisation of user data on the internet has only intensified such that the phrase ‘surveillance capitalism’ was coined by US academic Shoshana Zuboff in her book of 2019 to describe the practice.[2] The term represents how private companies, sometimes with questionable user consent, collect as much data as they can on their users with an objective to maximise profits.[3] Controversially, they have enjoyed the ability to employ technology that can track users across the internet.

The data harvesters build profiles that may include the age, health, interests, sex, political leanings, income and much more about their billions of users. The data harvesters then sell their ability to match these profiles against the type of people whom advertisers would like to reach.

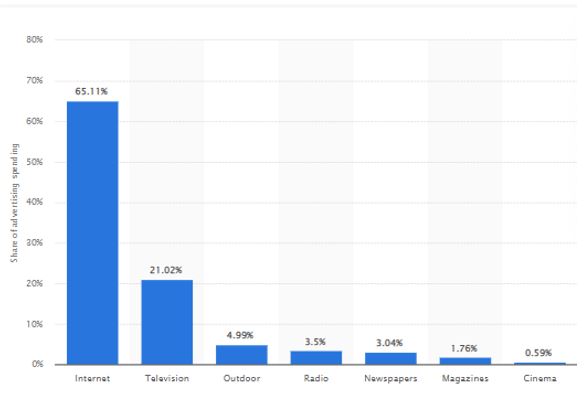

Targeted online advertising is among the world’s most successful business models, and almost certainly the most lucrative way any company has monetised offering free services. Due to the increasing amount of time people spend online and the efficiency of ‘display’ ads, online advertising is expected to reach 65% of global advertising spending by 2024.[4]

The sobering news, however, for companies that turn data into behavioural information is that the business model is coming under regulatory scrutiny and changing in ways that dent the money-making ability of the platforms that rely on off-site (or ‘third-party’) data for targeting, while strengthening the position of those platforms with significant on-site (or ‘first-party’) data. This dynamic seems likely to lead to more consolidation and the creation of ‘content fortresses’, a term that describes platforms rich in on-site data because they have the content to attract and hold users.

The biggest challenge for the online-ad business model is the elevation of online privacy as a social concern. This has two strands. The first is that EU policymakers are imposing tougher laws to restrict data use and make more transparent how data is used. The EU, which in 2018 introduced General Data Protection Regulation to protect privacy, is bringing in two laws that touch on privacy and further dictate how Big Tech should handle user data.[5] The Digital Services Act (when effective) will give users meaningful information on the ads they see online, including explanations on why they have been targeted with a specific ad[6] (even though Google and Facebook already provide this information to their users).[7] Under the act, platforms will not be able to target ads at minors, nor at people based on their ethnicity, sexual orientation or political views (although Google and Facebook only target the last of these categories). The final version of the Digital Markets Act agreed to in March limits the ability of platforms to combine user data from various sources for use in display ads.[8] The most worrying consequence for Big Tech? Such regulations spread worldwide, most worryingly for them to the US where lawmakers are mulling tech restrictions.

The other strand to the elevation of privacy concerns is that Big Tech companies – especially Apple – are offering privacy protections because, as Apple CEO Tim Cook says, the online privacy “emergency” is making society “less human”.[9] It just so happens that such moves often hinder tech competitors and marketers from gaining access to people’s data (in the case of marketers, when people view their ads).

One of Apple’s key privacy moves was its iOS14.5 update in 2021 that included ‘App Transparency Tracking,’[10] whereby users must agree to being tracked across apps. As the default setting is no tracking, Facebook, Snapchat, TikTok of China and YouTube among others have suffered as their ad targeting has become less effective. Even though the social-media platform has masses of first-party data, Meta said in February that it expects Apple’s changes to cost it US$10 billion in forgone revenue in 2022 (8.5% of 2021 sales). Alphabet-owned Google is implementing similar moves to Apple on Chrome browsers and Android phones from next year (although Google is expected to take a milder approach given the company’s pioneering roots in online advertising).

The Apple et al focus on privacy means platforms and services that rely heavily on third-party data to target ads might need to change their business models or face meaningful revenue headwinds as their targeting abilities are curtailed. Businesses that rely on advertising might spend more to acquire new customers or allocate more budget to platforms with valuable first-party data. An unintended consequence of this focus on privacy is that they reduce the competitiveness of small direct-to-consumer brands that proliferated over the past decade thanks to their ability to cost-effectively micro-target ads.

The second challenge to the online-ad business model is greater scrutiny of the unregulated ad exchanges on which prices for online ads are set in an auction. Texas and other US states have filed a lawsuit of collusion against Google in regards to the dominance of its exchange.[11] While Google denies the accusation and has sought to have the law suit thrown out, the probe that began in 2020 has made damaging accusations.

The most-noteworthy allegation in the Texas lawsuit filing in January this year was that Google took steps to prevent publishers from using ‘header bidding’. The term refers to when publishers insert code in the header of web pages to increase competition among online ad exchanges. The Texas filing said that when publishers used header bidding they received up to 70% more for their ads than when using Google’s ad exchange without header bidding.[12]

The header-bidding revelations in the Texas case seem to have aroused other policymakers. In the US, bipartisan-sponsored legislation is before Congress (the Competition and Transparency in Digital Advertising Act) that aims to stop companies from playing more than one role in digital advertising.[13] If enacted in its current form the legislation would force Google to spin off parts of its online-ad business although its core advertising properties (Search, Maps, YouTube,) would remain intact. In the EU and UK, regulators are examining how fair are online-display exchanges under their purview.

A third challenge for the online-ad business model is the political question of the dominance of internet platforms in society; specifically, whether their data gathering and use of certain algorithm-promoted content to maximise engagement (and therefore revenue) threaten democracy. To curb Big Tech’s influence, many (including Meta whistle-blower Frances Haugen)[14] urge that specialists be given access to the algorithms to tackle disinformation and prevent manipulation. The EU’s Digital Services Act does this to help researchers understand “risks on society and fundamental rights”.[15]

While such steps shouldn’t be pivotal, some demand that to protect democracy the ability of companies to collect data be restricted to the point of being abolished. While not a direct attack on online ads, any barriers to data collection would reduce the ability to target internet ads.

Hurdles to displaying ads, exposés on the operations of online-ad exchanges, industry restrictions on competitor data-gathering, and incremental government regulation might accelerate the decline in the effectiveness of display ads,[16] all while Apple preaches privacy[17] and is the de facto privacy police. But while the online-ad business model is being reined in, people will still see plenty of display ads. Businesses know that online advertising is a generally superior way to promote sales and brands thanks to its micro-targeting and measurement abilities. A mild rise in ad misfires won’t matter much to them.

It’s worth noting that while the use of data for targeted advertising is rightly under scrutiny, governments, armed with the technology to continuously track people within and increasingly outside their borders, and bad actors have the capabilities to abuse online privacy to a much greater extent than private companies that for the most part are only seeking to sell more goods or services to users who remain anonymous to them. Irrespective of the harshness of laws preventing ad targeting, the digital footprint and personal information of device users will remain traceable, and it might be naive to expect laws to prevent tracking. Some of the EU changes related to allowing iOS applications to be downloaded outside of the Apple app store diminish security and confidentiality.[18] Privacy only flickers as a political problem because most people seem untroubled that Big Platforms and others track them online.

But enough care and more might, especially as TikTok is gathering data globally that many allege heads to China.[19] While a drive is underway to ensure online privacy more matches offline privacy, nothing is likely to happen that stops advertisers from directing most of their budgets to online. In coming years, the online-ad category is only likely to extend its dominance of global advertising share.

The telling patent

In 2003, Google filed a patent titled ‘Generating user information for use in targeted advertising’. Zuboff marks this document as the break from when Google linked advertising only to search queries and gathered data only to improve the experience of searchers. The patent was a watershed because it overrode any privacy concerns to convert data into a message delivered to a person just when it might influence that person. [20]

The evolution of surveillance capitalism since then raises the question of how to guarantee privacy when these world’s Big Platforms have an incentive to further perfect the surveillance that has already made them rich and influential.

Privacy advocates say laws such as the EU’s only give users more control over the data gathered. They fail to prevent surveillance, which is why internet platforms generally support such laws, even if they try to slow their implementation. The only way to ensure privacy, says Tim Wu, now part of the Joe Biden administration with responsibility for Technology and Competition, is to codify an anti-surveillance regime; that is to say, to pass “laws that prevent the mass collection of behavioural data”.

Zuboff and Wu argue that to know everything about someone is to create the power to control that person. “We must dare to say what would sound like blasphemy in another age,” Wu argues. “It may be that a little less knowledge is what will keep us free.”[21]

Until, if ever, that happens – and there’s little chance of it occurring in the foreseeable future – expect endless targeted ads. But perhaps more might be mistargeted. And already enough of a privacy push is underway that it’s safer to buy an engagement ring before proposing.

By Michael Collins, Investment Specialist

Online advertising’s dominance

Distribution of advertising spending worldwide in 2024, by medium

Source: Statista. Published 17 February 2022

[1] Shoshana Zuboff. ‘The age of surveillance capitalism.’ Profile Books. 2019. Trenn’s nationality wasn’t stated but that implicitly meant he was from the US. Page 66.

[2] Zuboff. Op cit.

[3] Check out how Google gathers data on its users who typically agree to take-it-or-leave-it terms of service that disclaim away user rights. (See Google’s privacy policy here: policies.google.com/privacy; and terms of service here: policies.google.com/terms.) The company builds a record of searches, follows ‘web & app activity’ when people use Chrome, monitors Android mobile use to build location history, snoops on Gmail messages, sucks up data from Google Assistants, and tracks where people go via Google Maps. Fed into the data is any device that can be connected to Google accounts. So too hoovered is data from YouTube ‘search history’, YouTube ‘watch history’ and any app or product connected to Google or its parent, Alphabet, such as Google Play Store and the Google Nest range of smart cameras, doorbells, security systems, speakers and thermostats. See ‘All the ways Google tracks you – and how to stop it.’ WIRED. 27 May 2019. wired.com/story/google-tracks-you-privacy/. Google, to extend the data gathering in 2019, to cite one example that sparked controversy, placed a hidden microphone into Google Nest Secure home anti-intrusion devices when the product was rejigged to support the voice-activated Google Assistant service. NYMag. Intelligencer. ‘Google sorry it forgot to mention secret microphones.’ February 2019. nymag.com/intelligencer/2019/02/google-sorry-it-forgot-to-mention-secret-microphones.html.

Meta probably hoovers up even more personal data. The company’s Facebook site seeks to ensure its two billion users are comfortable by grouping them via algorithms with ‘friends’ with common interests and like-minded views. The object is to keep users scrolling through Facebook as long as possible so Facebook can hoover information on what users do within its site, and through trackers installed around the web the company collates what users look at elsewhere online.

[4] Statista. ‘Distribution of advertising spending worldwide in 2024, by medium.’ Published 17 February 2022. Statista forecasts the global advertising model to be worth US$1 trillion by 2024, an optimistic forecast. statista.com/statistics/269333/distribution-of-global-advertising-expenditure/. In fiscal 2021, Alphabet earned US$258 billion from Google online ads, 82% of its annual revenue.

[5] European Commission. ‘Europe fit for the digital age: Commission proposes new rules for digital platforms.’ 15 December 2020. ec.europa.eu/commission/presscorner/detail/en/IP_20_2347

[6] European Parliament. Briefing. EU legislation in progress. ‘Digital services act.’ March 2021. europarl.europa.eu/RegData/etudes/BRIE/2021/689357/EPRS_BRI(2021)689357_EN.pdf.

Every Google display ad has a little link on the bottom right that says: “Why am I seeing this ad”.

[8] European Parliament. ‘Deal of Digital Markets Act: EU rules to ensure fair competition and more choice for users.’ 24 March 2022. europarl.europa.eu/news/en/press-room/20220315IPR25504/deal-on-digital-markets-act-ensuring-fair-competition-and-more-choice-for-users

[9] ‘Tim Cook warns of privacy ‘emergency’ in attack on social media and search engines.’ The Telegraph of the UK. 12 April 2022. telegraph.co.uk/technology/2022/04/12/tim-cook-warns-privacy-emergency-attack-social-media-search/

[10] TechCrunch. ‘Apple’s App Tracking Transparency feature has arrived – here’s what you need to know.’ 27 April 2021. techcrunch.com/2021/04/26/apples-app-tracking-transparency-feature-has-arrived-heres-what-you-need-to-know/

[11] Ken Paxton. Attorney General of Texas. ‘AG Paxton leads multistate coalition in lawsuit against Google for anticompetitive practices and deceptive misrepresentations.’ 16 December 2020. texasattorneygeneral.gov/news/releases/ag-paxton-leads-multistate-coalition-lawsuit-against-google-anticompetitive-practices-and-deceptive. Another Texas-led lawsuit is that Google is deceptively tracking users. Ken Paxton. Attorney General of Texas. ‘AG Paxton sues Google for deceptively tracking users’ location without consent.’ 24 January 2022. texasattorneygeneral.gov/news/releases/ag-paxton-sues-google-deceptively-tracking-users-location-without-consent

[12] Texas Attorney General filing. ‘In re: Google digital adverting antitrust litigation.’ Note 358 pages 123 to 124. Filed 14 January 2022. texasattorneygeneral.gov/sites/default/files/images/child-support/20220114_195_0_States%20Third%20Amended%20Complaint.pdf. See also Andrew Orlowski. ‘Google’s unhealthy dominance of advertising is finally being exposed.’ 21 March 2022. https://www.telegraph.co.uk/business/2022/03/21/googles-unhealthy-dominance-advertising-market-finally-exposed/

[13] ‘GOP-led legislation would force breakup of Google’s ad business.’ The Wall Street Journal. 19 May 2022. wsj.com/articles/gop-led-legislation-would-force-breakup-of-googles-ad-business-11652969185

[14] The question should be “’how’ and ‘who’ should get it, rather than ’if’”, says Haugen. Frances Haugen. ‘Civil society must be part of the Digital Services Act.’ 30 March 2022. ft.com/content/99bb6c10-bb09-40c0-bdd9-5b74224a5086

[15] European Commission. ‘A Europe fit for the digital age: New online rules for users.’ ec.europa.eu/info/strategy/priorities-2019-2024/europe-fit-digital-age/digital-services-act-ensuring-safe-and-accountable-online-environment/europe-fit-digital-age-new-online-rules-users_en

[16] ‘You’re still being tracked on the internet, just in a different way.’ The New York Times. 6 April 2022. nytimes.com/2022/04/06/technology/online-tracking-privacy.html

[17] Apple. ‘A day in the life of your data. A father and daughter in the playground.’ March 2021. apple.com/privacy/docs/A_Day_in_the_Life_of_Your_Data.pdf

[18] So alleges Apple CEO Tim Cook. The Wall Street Journal. ‘Apple’s Tim Cook warns proposed antitrust laws will leave users with less choice for privacy.’ 12 April 2022. wsj.com/articles/apples-cook-warns-proposed-antitrust-laws-will-leave-users-with-less-choice-for-privacy-11649773362

[19] BuzzFeed News. ‘Leaked audio from 80 internal TikTok meetings shows that US user data has been repeatedly accessed from China.’ 17 June 2022. buzzfeednews.com/article/emilybakerwhite/tiktok-tapes-us-user-data-china-bytedance-access

20 Zuboff. Op cit. Page 80

[21] Tim Wu. ‘Bigger brother.’ The New York Review. 9 April 2020 edition. nybooks.com/articles/2020/04/09/bigger-brother-surveillance-capitalism/

Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan.