Investing in airports

The Development of Commercial Airline Travel

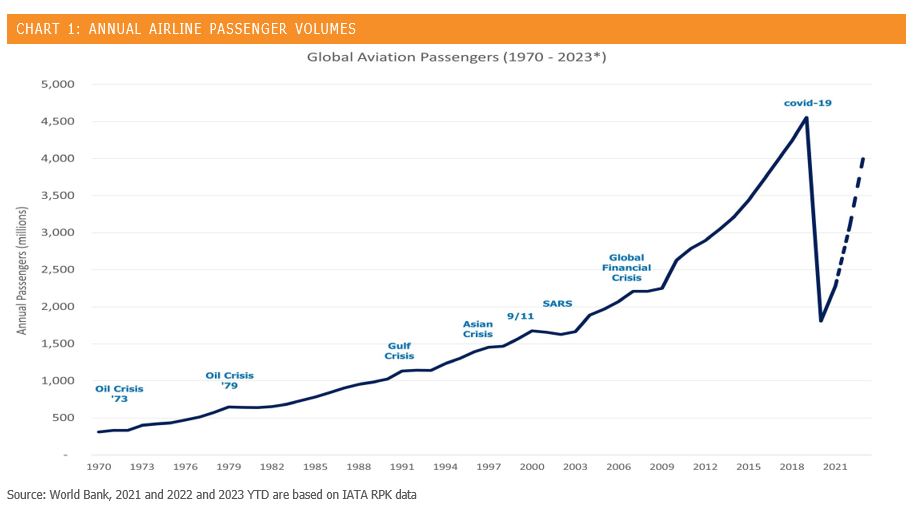

The deregulation of the global aviation industry1 saw a steep change in the level of growth of air travel as increased competition, including the arrival of low cost carriers into the marketplace, together with the larger and more fuel efficient planes, saw prices fall and air travel become more accessible. The World Bank estimated carriage of 4.5 billion airline passengers globally in 2019, aup from 1.7bn in 2000, an increase of 267%.2 Even with all the disruptions from COVID, IATA estimates that air travel rebounded quickly, back within 6% of 2019 levels by June 20233.

While air transport has had its challenges over the recent years, it has remained resilient. We expect growth to continue, driven by increasing household wealth and increasing demand for air travel expected to double by 2040.3 All of this growth has, and will continue to be underpinned by the essential airport infrastructure that facilitates air travel.

1 US - 1978; UK - 1991; Europe - 1992; Australia - 1990

2 https://data.worldbank.org/indicator/IS.AIR.PSGR?end=2021&most_recent_year_desc=true&start=1970&view=chart

3 https://www.iata.org/en/iata-repository/publications/economic-reports/air-passenger-market-analysis---june-2023/

What Are the Key Revenue Drivers of Airports?

Airports earn revenue primarily from two categories:

1. Aeronautical Revenues

Revenue is usually earned as a per-passenger charge and/or a charge based on the size of the aircraft, and such aeronautical revenues are normally subject to economic regulation. Revenues grow as airports invest in terminal and airfield facilities (new gates, expanded terminals, runway widenings or improvements, aircraft parking spaces and related facilities) to meet increasing passenger demands.

2. Commercial Revenues

> Retail leases – Airports earn rent from retail space within the terminal buildings for stores ranging from duty-free to restaurants and general merchandise (clothes, watches, souvenirs, books, etc.). The leases are typically structured with minimum guaranteed rents and upside from sales above certain thresholds.

> Car parking and ground transport, including bus and taxi access charges.

> Property - Airports own vast tracts of land that are sought after by a range of airport users including car rental agencies, airline offices and associated service providers like freight, catering, ground handling, fueling, maintenance and hotels.

Many of these revenue streams have grown consistently over time. Leases may also feature inflation-linked adjustments or established pricing mechanisms that are built into contractual arrangements. In some cases, such as car parking and property rental, the airport has greater pricing discretion in order to optimise the balance between revenue and utilisation.

Airports are characterised as delivering relatively stable revenues that are fairly resilient to changes in economic conditions. As illustrated in the chart above, while specific events can have a short-term impact on air travel, passenger growth has typically rebounded within a short time frame back to the longer term trend.

Structural Tailwinds Assisting Airports

The economics of operating an airport has strong linkages to demographic factors such as increasing wealth and the associated growth in discretionary spending, along with growing global demand for mobility via access to air travel. Both airline competition and capacity has grown over time which has seen airfares decrease in real terms. This trend shows no sign of abating due to improved airline capacity utilisation, new aircraft orders and advances in technology.

What Are the Key Costs?

The main costs for airports typically relate to:

Security - the provision of mandated security measures, which are recovered from airlines through passenger charges

Utilities - the cost of electricity, water and gas used by the airport

Facilities management - general cleaning and kerbside management

Costs are usually scalable and relatively fixed, which means the airport can expand its passenger facilitation and related activities to meet growing passenger numbers without significant increases in its cost base.

Capital Investment and Expansion

Capital investment and expansion are usually significant requirements of airports in order to facilitate growing passenger numbers. Airports are typically able to increase their charges to recover a fair return on capital expenditure to provide additional capacity or to improve service or safety standards.

In addition, airports may undertake capital investments to meet demand that is evident through existing capacity constraints, hence the return on capital invested is relatively reliable.

What Are the Key Risks?

1. Disruptive Events and Disasters

While the risk of major weather events, pandemics, airline crashes and terrorism is low relative to the volume of air travel, each of these is acknowledged as a real risk. History has demonstrated that while these disruptive events can have a short-term impact on patronage, volumes typically return to trend after a short period.

2. Competition From ‘origin and Destination’ Airports Vs ‘Hub’ Airports

Origin and destination airports typically have more stable passenger demand and don’t compete significantly with other destinations and airports. In contrast, hub airports can be materially impacted if an airline chooses to use an alternative hub airport or fails financially.

3. Airline Withdrawals or Bankruptcies

An airline’s collapse can have a short-term financial effect, but other airlines generally satisfy unmet demand through additional services and aircraft up-gaugings (using a larger aircraft on the existing service). An airport’s revenues are generally not sensitive to which airline provides capacity to passengers.

4. Regulatory Intervention

Airports and their airline customers are generally aligned in desiring effective commercial arrangements and working relationships, rather than relying on regulatory intervention. Higher-quality airports typically manage regulatory compliance and relationships diligently.

5. Social Licence

While privately owned, airports are viewed as ‘public’ assets and ‘owned’ by their many stakeholders – customers, passengers, ‘meeters and greeters’, local communities, lobby groups, government, local councils and municipalities, etc. Honouring its social licence is vital for an airport over the long term to avoid regulatory intervention.

Why Are Airports Considered Infrastructure?

For an asset to meet our definition of infrastructure, it must satisfy two key criteria:

1. It Is Essential to the Efficient Functioning of a Community

As commercial airline travel has become a common form of transportation, airports have become essential assets to communities.

2. Earnings Are Not Sensitive to Competition, Commodity Price Movements or Sovereign Risk

> Airports enjoy monopoly positions as there is usually limited choice within a catchment area from where people can access air travel.

> As airport revenues are linked to the number of passengers and/or the number and size of the aircraft using the airport, large increases in oil prices tend to only affect growth at the margins, as it is the airlines who have to manage these costs (which are often passed on via fuel surcharges on tickets).

> Airports are governed by regulatory frameworks that are either stipulated or ‘light-handed’ in their control over the airport’s pricing and related economics.

> Capital management and leverage are typically well managed within sensible limits to ensure debt can be serviced comfortably, regardless of disruptive global or local events and economic conditions.

How Are Airports Regulated?

Governments take responsibility for mandating the security standards

of an airport’s operations, given the associated requirements of immigration and border security. Additionally, because airports are important economic and physical infrastructure, governments usually impose some form of economic regulation. This is usually effected in one of two ways via some form of price control.

1. Single Till Regulation

In single till regulation, both the aeronautical and commercial businesses are subject to price control or monitoring to ensure the total returns that accrue to the airport are within set regulatory parameters. Examples of single till airports include London Heathrow and a number of other UK airports.

2. Dual Till Regulation

In dual till regulation, the aeronautical activities are subject to some form of price control or price monitoring to ensure the airport is charging a fair, but not excessive, price for the passenger-related facilitation activities. This is by far the most common form of regulation.

Dual till airports are more attractive investments because the commercial segment can usually earn a higher rate of return than the regulated aeronautical segment. Examples of dual till airports that are publicly listed include Sydney, Auckland, AENA (a portfolio of principally Spanish airports), Zurich, Frankfurt, Copenhagen and Paris.

Analysing the Financial Performance of Airports

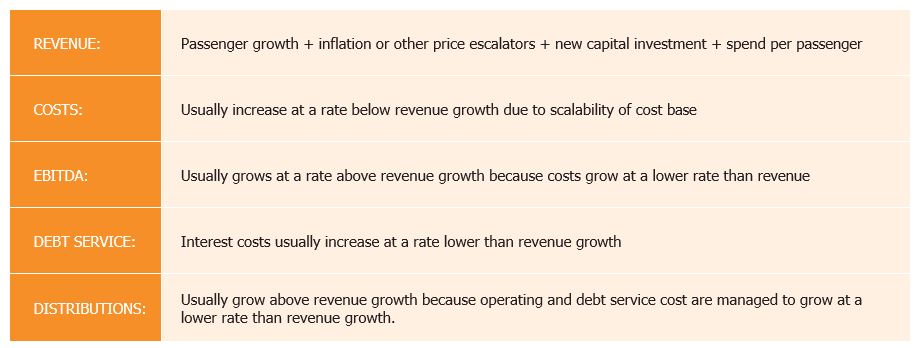

Having regard to the revenue and cost drivers of airports outlined in this paper, airport profitability can be determined as a function of the following variables:

Resilience of Airports

Since the development of commercial aviation during the post-World War II era, passenger volumes at major commercial airports has grown at multiples of GDP over any medium-term period. This growth reflects many underlying factors including increasing wealth, real reductions in the cost of air travel, developments in aircraft technology and improvements in international airspace regulation.

Global passenger growth has been fairly consistent since the mid-1960’s. Even with the decline in travel through the COVID-19 pandemic, we have seen a prompt bounce back of passenger volumes. The resilience of air travel to external shocks and the speed of the recovery to a long term upward trajectory is evident, as shown in chart 1.

High quality airports benefit from a near monopoly stream of passengers from which they are able to generate both aeronautical and commercial revenues. Regulation is structured to allow the aeronautical operations (including passenger, landing and ancillary fees) to earn returns in line with the cost of capital, whilst there are typically no restrictions placed on the returns that can be generated from non- aeronautical operations, such as retail, parking and commercial property.

Airports form a core part of Magellan’s definition of infrastructure and have, over time, delivered robust financial performance and generated healthy returns for investors. We believe that airports remain a global growth sector and offer an attractive balance of regulated and competitive earnings potential.

Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan.