Infrastructure and decarbonisation

July 2021

Under the Paris Agreement (a legally binding international treaty on climate change), governments agreed to keep global warming ‘well below’ 2 degrees Celsius, and to ‘make efforts’ to keep it below 1.5°C. The Intergovernmental Panel on Climate Change released a report in 2018 that concluded that global carbon emissions need to reach ‘net zero’ around mid-century to limit warming to 1.5°C. One outcome of this focus on climate change is that businesses that have high carbon emissions need to limit their emissions. Otherwise, they could be regulated out of existence.

The infrastructure sector has a number of businesses that have high carbon emissions. To the extent, however, that high-carbon emissions are viewed as a proxy for investment risk, the reported carbon emissions for regulated electricity utilities (that represent more than 85% of the carbon emissions in tour Core Infrastructure portfolio) are misleading. A more detailed analysis of the investment risks arising from the energy transition reveals that regulated electricity utilities are beneficiaries of the shift to renewables because the energy transition presents meaningful opportunities

The decarbonisation risk for utilities

Electricity utilities include power generation, electricity transmission and electricity distribution activities. More specifically, energy is produced at power-generating plants and then carried by high-voltage transmission lines from the power-generating plants to substations. Distribution lines then deliver electricity from the substations through power lines to residential, commercial, industrial and other customers. Transmission and distribution infrastructure is the backbone of the electric power system as it delivers the power to end customers.

Carbon accounting is a process that assesses the level of carbon-dioxide-equivalent emissions an organisation emits by quantifying the amount of greenhouse gases the organisation produces, whether directly or indirectly. It’s already clear that organisations with hefty carbon emissions will need to transition to production processes that emit less carbon or face the risk of being regulated out of business. Accordingly, activities that have high carbon emissions scores are often viewed as facing investment risk.

As noted above, the infrastructure sector is typically associated with high carbon emissions due to the emissions generated by the integrated power and the transmission and distribution sectors (sectors many investors classify under the broader term ‘electricity utilities’). These sectors have two major sources of carbon emissions:

- Carbon emitted when the electricity is generated; and

- The energy losses that occur as electricity is transported.

- Carbon emitted at generation

While renewable energy sources such as solar and wind-power generation emit zero carbon, gas or coal-fired power generation have high carbon emissions. Companies that own power generation plants that rely upon such fossil fuels thus have high emissions.

We determine membership of our universe of infrastructure companies by, among other things, excluding any company that derives more than 25% of its earnings from unregulated (or ‘competitive’) power generation. Thus our investment portfolios largely avoid exposure to merchant power-generation businesses. This means that power-generation companies in the our infrastructure investment universe will mainly have regulated operations.

Investment in regulated power generation is agreed with the regulator and is subject to the ‘regulatory compact’. This term describes how in exchange for submitting to economic regulation, a utility is granted an exclusive licence to operate within a region and to recover its costs, including a fair rate of return on the capital it has invested to provide its service. As a result, regulated power-generation facilities will have been approved by the public authorities, and the utility owner can reasonably expect to recover its costs and earn a fair rate of return on the capital invested in those facilities. If the carbon emissions need to be reduced, the utility will work with public authorities to formulate a plan that reduces emissions and services the public while earning decent returns for the utility.

While many regulated power-generation facilities have reduced their fossil-fuel operations or even retired them to reduce their carbon footprint, we are not aware of any that have incurred economic losses from such action thanks to the regulatory compact. Provided this compact remains, we do not think regulated power generation faces material investment risk as the world seeks to reduce carbon emissions.

- Energy losses and electricity in transport

The rules of carbon accounting attribute carbon emissions to the electricity transmission and distribution systems according to how much carbon was emitted creating the electricity the networks transport. Hence, when electricity is generated from a coal-fired power station, the energy losses incurred as the electricity is transported are held to have emitted carbon in proportion to the carbon emitted at the coal-fired power station. Provided it is efficient, a transmission network does not cause the carbon emissions. But it is nonetheless attributed with the emissions.

While there is a general need for society to transition electricity generation to less carbon-intensive sources, an electricity transmission and distribution network is agnostic to the source of the electricity pumping through its wires. Moreover, owners and operators of transmission assets typically have limited (if any) input on the type of fuel source used to generate the electricity delivered. In this instance, we do not believe that the carbon emission score is a fair or appropriate measure of investment risk.

Opportunities from decarbonisation

While no country has yet produced a detailed plan on how it might achieve net zero by 2050, many countries have committed to this objective and have laid out vague plans as to how they might proceed. These plans seek to reduce net emissions to zero by turning to renewables and by electrifying the economy.

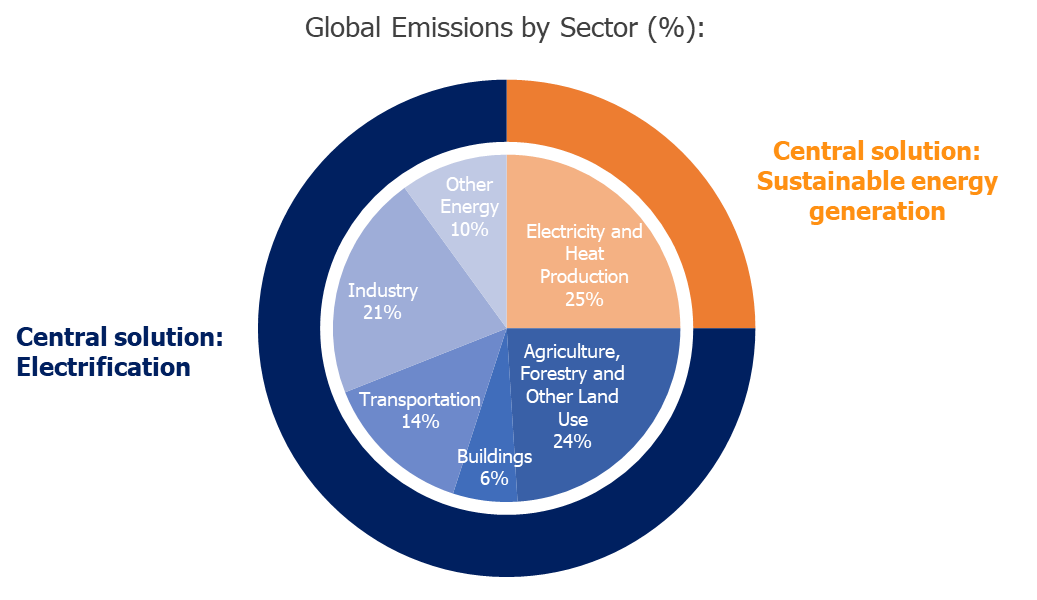

The chart shown below shows the Intergovernmental Panel on Climate Change’s assessment of the source of global emissions.

Source: Intergovernmental Panel on Climate Change (2014)

While the electricity and heat-production sector is the largest contributor to global emissions (25%), this sector faces a significant opportunity as economies electrify. Essentially, decarbonisation will require that fossil-fuel-based energy sources be replaced by renewable-energy sources. Significant investment in the electricity grid will be needed to do this. Then there are the users of energy (the sectors shaded in blue) that account for approximately 75% of carbon emissions. The electrification of these sectors is a key part of achieving net-zero emissions. This can occur only if there is massive investment into renewable energy. The shift is an opportunity to invest in electricity transmission and distribution capabilities as the new sources of renewable energy will need to be connected to the grid.

The progressive, and ultimately significant, improvement in the effectiveness and efficiency of renewable energy over the past 30 years means there is a pathway to achieving net zero. For example, over the past decade, the US’s electricity industry has become significantly less carbon-intensive despite minimal federal action. This is due principally to the replacement of coal by natural gas; coal, which provided 45% of the electricity generated in 2010, provided just 19% in 2020. But this progress needs to continue in the 2020s and beyond if the US and the world are to achieve net zero.

The administration of President Joe Biden has pledged more aggressive climate-change policies. In January 2020, Biden signed an executive order calling for the US to reduce its net greenhouse-gas emissions to zero by 2050, with an objective to make the electricity sector emissions-free by 2035. This 2035 objective is ambitious and will require an accelerated investment program for electric power companies and new technologies related to battery storage, carbon sequestration and green hydrogen.

In December 2020, researchers at Princeton University published a report outlining how US emissions might be reduced to net zero by 2050. The study outlined various paths to that goal with all paths relying upon an electricity sector decarbonised and expanded in scope and size. The study outlined one scenario where wind and solar capacity would need to expand each year to 2025 by about 40GW (33GW were added in 2020, a record amount) before hitting 70GW to 75GW a year from 2026 to 2030. The Princeton study estimates that if these targets were met then by 2030 wind and solar farms would be providing about 50% of the US’s electricity needs, up from 9% in 2019.

The addition of significant amounts of renewable energy would require a larger transmission network. The Princeton study estimated that high-voltage transmission capacity would need to increase by 60% over the coming decade.

Over the past 20 years, utilities have diversified sources of power generation driven by government-mandated renewable portfolio standards. The remote locations of most major renewable power-generation projects require new high-voltage transmission systems to deliver the energy to the grid. In the US, the National Renewable Energy Laboratory projects investment in US transmission infrastructure of up to US$9 billion per year to connect remote areas of power generation to the grid.

Under current mandates in 29 states and the District of Columbia, renewable energy is required to account for up to 40% of electricity generation within the next 12 years. The government standards will require increased infrastructure investment as the most cost-effective of these renewable resources are often located far from load centres and the existing grid.

Renewables represent a significant capital-investment opportunity, and utility companies are accelerating replacement of their coal-fired fleets with cheaper, renewable-energy-powered plants. Until recently, the renewable energy sector consisted largely of independent power producers. Electricity utilities acted mostly as buyers and sellers of related power-purchase agreements but held off on large-scale production projects that would add to their ‘rate base’, a term for the capital invested on which a utility can earn a regulated return. That paradigm has shifted, with regulated utilities experiencing a large increase in renewable energy capital expenditures. Today in the US, regulated utilities own approximately 12% of renewable energy resources and the sector is on pace to own about 70% by 2030.

While renewable-energy-generation plants gain traction, renewable energy storage is another potential area of growth within the utilities sector. Currently, there is not enough storage capacity to house all the energy renewables generate. Storage capacity, which increases reliability and availability, will need to increase by multiples of current capacity levels to meet the dramatic projected growth in renewables.

As noted above, decarbonisation requires the replacement of fossil-fuel-based energy sources with renewable energy sources combined with a significant investment in the electricity grid to enable increased electrification of the economy. While the details of the regulatory models applied to regulated utilities differ somewhat across jurisdictions, the regulatory approach commonly permits the regulated utility to earn a ‘fair’ rate of return on the capital employed in the regulated utility business and so the earnings of a regulated utility will grow as the amount of capital employed grows. Hence, decarbonisation represents a significant opportunity for regulated utilities to grow earnings.

Investment supporting the energy transition will not only provide attractive opportunities in future years but also will drive earnings growth today. Regulated utilities around the world have embraced the challenge to reduce emissions and, with the support of regulators, have been making meaningful strides in emissions reduction through value-generating investment. The following table illustrates for a sample of US electricity utilities the significant emissions improvements that have occurred over recent years, the ambitious emissions targets these utilities have adopted and the attractive earnings growth that such investment supports.

|

Company |

Emissions reduction achievements |

|

Company-guided long-term |

Company-guided capital investment ($US) |

|

Alliant Energy |

42% reduction since 2005 |

Net zero by 2050 |

5% to 7% pa |

$6b |

|

American Electric Power |

74% reduction since 2000 |

Net zero by 2050 |

5% to 7% pa |

$37b |

|

Duke Energy |

39% reduction since 2005 |

Net zero by 2050 |

5% to 7% pa |

$124b |

|

Emera |

39% reduction since 2005 |

Net zero by 2050 |

7.5% to 8.5% pa |

$7b |

|

Fortis |

15% reduction since 2015 |

75% reduction by 2035 versus 2019 |

5% to 7% pa |

$20b |

|

Southern Company |

52% reduction since 2007 |

Net zero by 2050 |

5% to 7% pa |

$40b |

|

WEC Energy |

>50% reduction since 2005 |

Net zero by 2050 |

5% to 7% pa |

$16b |

|

Xcel Energy |

51% reduction since 2005 |

Carbon free electricity by 2050 |

5% to 7% pa |

$24b |

When it comes to emissions reduction, US regulated utilities have a track record of progress that few, if any, industries can match. Combine that with their opportunities as the world tackles climate change and they stand among the beneficiaries of the transition to greener energy.

By Gerald Stack, Head of Investments, Head of Infrastructure and Portfolio Manager

Go to the InReview website for more insights.

If you have read the article and would like 0.25 CPD hours, complete the quiz below. You will need an 80% pass rate to receive the accreditation which will be automatically emailed to you after you press submit.

Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan.