China's deflating property market threatens wider economic trouble

October 2022

The Reserve Bank of New Zealand a year ago became the first advanced central bank to raise interest rates to cool its economy to tackle inflation. So far, the RBNZ has lifted its key rate seven times. The Bank of England, starting last December, has boosted its benchmark rate seven times too. The Reserve Bank of Australia has hiked the cash rate six times in six months; the Bank of Canada five times in seven months. The Federal Reserve has hoisted interest rates five times over six months. The European Central Bank has conducted two rate increases, one by a record amount. In the emerging world, Banco Central do Brazil has raised its Selic rate by 11.75 percentage points in 12 steps. The tally for El Banco Central de la República Argentina is eight increases that tally to 29.5 percentage points. The Reserve Bank of India has boosted its policy repo rate three times this year. What’s the People’s Bank of China done? It has loosened monetary policy again and again since late 2021.

In December last year, the PBOC ordered the cut of the one-year loan prime rate, one of two de facto benchmark lending rates.[1] In January, the PBOC forced cuts in the one-year and five-year loan prime rates, where the five-year rate is the other de facto key rate.[2] In April, the PBOC reduced the amount banks must hold as reserves so they had more to lend.[3] In May, the PBOC instructed banks to again cut the five-year loan prime rate.[4] In August, the PBOC orchestrated a spate of rate cuts,[5] instructed banks to keep lending,[6] and organised special loans of up to US$29 billion for property developers.[7] In September, to support a tumbling yuan that trades within a daily PBOC-set band, the central bank cut the bank forex reserve ratio[8] – yet 10 days later the currency still fell below 7 to the US dollar compared with 6.35 at the start of the year. Same month, the PBOC directed state banks to cut deposit rates for the first time since 2015,[9] manoeuvred to support the yuan that still fell to a record low of 7.2 against the greenback the next day,[10] and applied tweaks to encourage lending to first-time home buyers.[11] Over the 10 months, Beijing has repeatedly announced fiscal stimulus.[12]

Policymakers in China are pursuing such remedies because China’s economy is hobbled in at least 10 ways. Standing out is the troubled property sector, which drives about 20% of GDP and represents about 66% of urban household wealth. The country is riddled with half-built residential buildings, which is deflating a property bubble. The history behind such worries is that policymakers super-stimulated the property market to compensate for lost exports to get through the global financial crisis of 2008-09. Since 2020, to quell overheating, however, officials under a ‘three red lines’ policy[13] have restricted credit to property companies, which has dented building activity and bankrupted developers (most notably, China Evergrande Group that has an estimated US$300 billion in liabilities).[14] Home prices have slid every month over the year to August.[15] Since Chinese buy off the plan, many people now own homes yet to be built – The Economist estimates that only 60% of homes pre-sold between 2013 and 2020 have been delivered.[16] Many of these dudded pre-buyers are boycotting mortgage payments – hundreds of thousands of borrowers in more than 100 cities, by some counts.[17] The property crisis so imperils the finances of local governments – they rely on land sales for much of their revenue – cities have implemented about 70 policies to support property, to little avail.[18]

The property crisis highlights a second weakness. The country’s business, government and household debts reached 280% of GDP in 2019 and can’t rise endlessly. Central government debt at 73% of output in 2022, while low by international standards, curtails Beijing’s ability to bail out the property sector[19]

China’s debt-fuelled property woes link into a third challenge; the stability of China’s banks, especially the country’s 4,000 small and mid-sized banks. In April, several small banks in eastern landlocked Henan Province failed. The fact that authorities silenced depositors entitled to compensation shocked China watchers, especially when on July 10 thugs assaulted depositors in front of police when they protested outside the People’s Bank branch office in Henan’s capital of Zhengzhou.[20] China’s largest banks, having lent to property companies and to risky emerging countries as part of the Belt and Road Initiative, are too shaky to absorb tottering smaller banks. The concern is that a rash of small bank failures could trigger a systemic financial crisis.

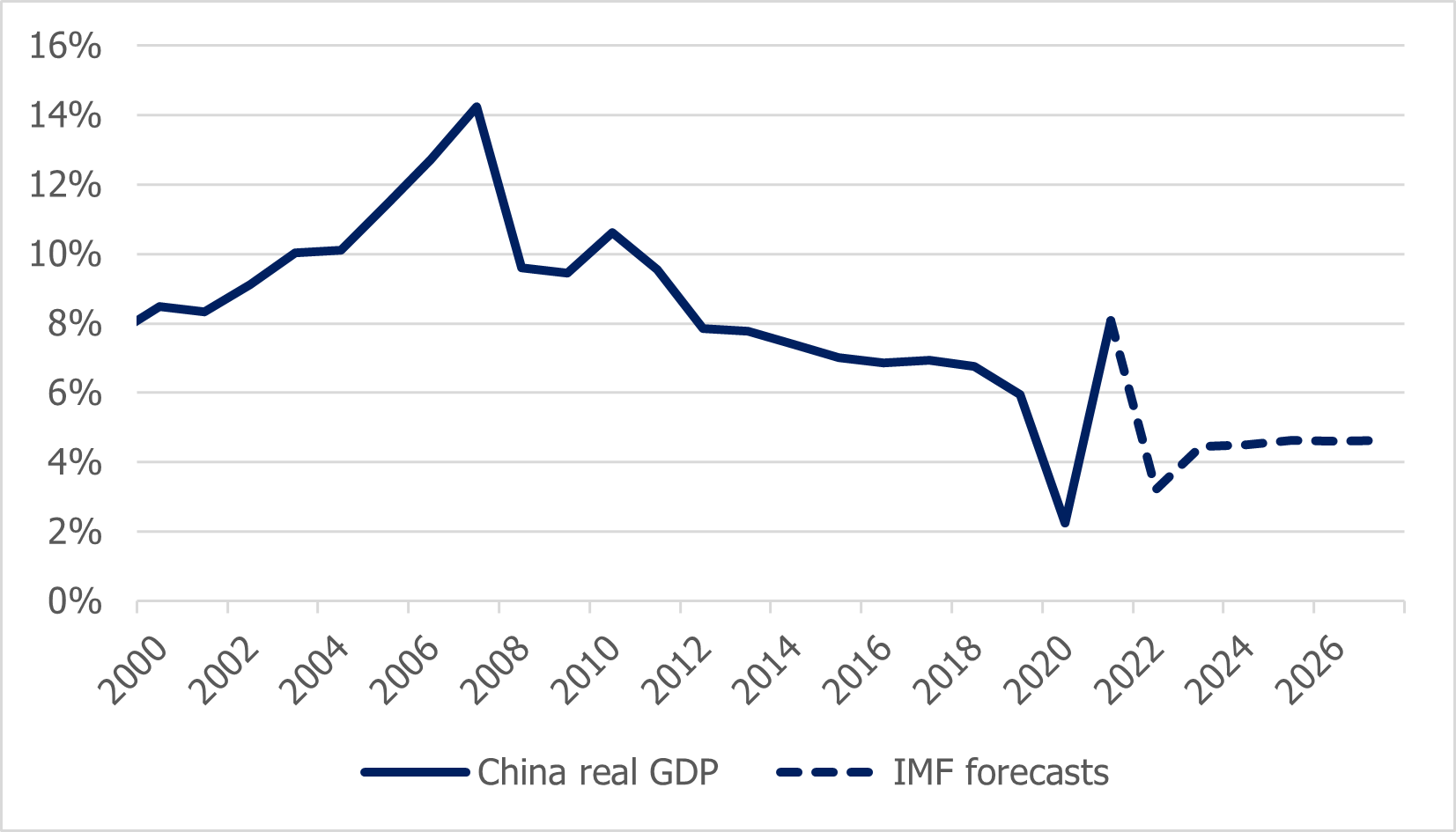

The perils surrounding China’s banks are amplified by a fourth problem; covid-19. To enforce a zero-covid policy, Chinese authorities have locked down large cities to control the disease because they can’t rely on the inferior China-made vaccines and refuse to import foreign ones. These repeated lockdowns of up to 30% of China’s population have stifled economic activity, created youth unemployment of 20%, undermined business and consumer confidence, prevented people from scouting for properties and stirred protests. This lockdown blow to the economy blunts the effect of monetary and fiscal stimulus. China’s wobbly banks are no longer protected by the double-digit economic growth of yesteryear, or even the 7.1% annual growth from 2011 to 2020.

China’s worst-ever heatwave and the linked drought is a fifth economic misfortune, even if a temporary problem.[21] Factories have been forced to cut production because hydro generation has halved.[22] Water levels have dropped enough to impede river trade. Food prices have jumped. Authorities have warned the drought poses a “severe” threat to the coming autumn harvest, when 75% of the country’s grain is gathered.[23]

China’s sixth trial is that the rate increases implemented by about 90 central banks (according to Bloomberg’s tally) are reducing demand for Chinese exports.[24] A seventh worry is that the deglobalisation fanned in part by China-US tensions deters the Western investment that drove China’s economic ascension. Higher wages in China, as part of the government’s spluttering push to switch from an export-and-investment-led economic model to a consumption-driven protype, deters investment too.

An eighth handicap is China-US strains are cutting China off from Western technology, especially related to artificial intelligence, microchips and supercomputers. A ninth and durable impediment is China’s poor demographics. A record low fertility rate of 7.52 births per 1,000 people mean the country’s population of 1.4 billion is ageing and close to shrinking, commonly accepted as drags on economic dynamism.[25]

A tenth handicap is President Xi Jinping’s nationalistic and statist ideological bent. Xi favours state intervention in the economy. He has diverted resources to the state sector and preferred industrial ventures while curbing the dynamism of the private sector, especially that of the technology industry. Productivity, the lifeblood of rising living standards, is threatened.

China’s troubles mean its economy is expected to expand only about 3% in coming years, effectively at recession levels – the World Bank in October reduced its China growth forecast for 2022 from 5% to 2.8%. Such a slowdown comes with local and global consequences. Within China, the biggest risk is the public’s faith in the Chinese Communist Party could be tested, especially people’s confidence in Xi, China’s most powerful ruler since Mao Zedong. Disagreement over an economic recovery plan is even stirring opposition to Xi inside the Communist Party, including within the supreme Politburo Standing Committee (cabinet). “For the first time since the 1989 Tiananmen Square protests, China’s leader is facing not only internal dissent but also an intense popular backlash and a real risk of social unrest,” assesses Cai Xia, a professor at the Central (Communist) Party School from 1998 to 2012.[26]

Any China slump would be felt around the world because China’s output comprises about 19.6% of global GDP on a purchasing-power-parity basis. Many of the commodities, currencies and other assets, priced on an assumption that China will endlessly expand, could falter. Countries dependent on China (Australia, Brazil and Germany that just recorded its first trade deficit since 1991, to cite two) might struggle. Stressed emerging countries tied to the Belt and Road Initiative could suffer because China, having spent US$1 trillion on the project, is no position to release them from punishing terms.[27] A Xi-led CCP under pressure at home could double-down on ‘wolf warrior’ diplomacy and nationalism. Some fret it makes an invasion of Taiwan more likely.[28]

China escaped the worst of the global financial crisis but its reaction may have cultivated a local brew of the same toxicity that makes it unlikely China will become the world’s biggest economy any time soon, even ever. At the very least, an era of slow Chinese growth is dawning. At worst, a Chinese implosion could be the biggest blow of all for a fragile world economy.

To be sure, China’s economy is still expanding, the manufacturing sector is in fine shape and the country’s state-backed financial system can absorb huge losses. A drop in imports is preserving China’s trade surplus. China’s spending on research and development now reaches 85% of that spent by the US. So innovation must be coming that will spur productivity.[29] There are no signs the masses are unruly. With its surveillance technology, perhaps no autocratic regime has been better equipped to stifle dissent. Xi is expected to cement a third term. But his power might be weakened in the process, perhaps a beneficial outcome. Rather than fuel aggression, China’s economic woes might push Beijing towards a rapprochement with Washington.[30] China’s slowdown at least helps the world curb inflation. Beijing’s move towards a consumption-driven economy is the right long-term solution, as is prioritising high-tech and renewable sectors. But such solutions will take time.

They can’t quickly solve that four decades of growth have stirred imbalances that Xi is exacerbating with lockdowns, aggression abroad and an ideology that restrains economic development. Even more PBOC support might be insufficient to avoid the worst.

By Michael Collins, Investment Specialist

Source: China’s economic statistics come from the IMF’s World Economic Outlook Database released in April 2022 unless otherwise stated. The database can be found at: imf.org/en/Publications/WEO/weo-database/2022/April. China’s non-financial company, government and household debts in 2019 are from the Bank of International Settlements.

Source: IMF World Economic Outlook database 2022

[1] ‘Chinese banks cut borrowing costs to counter economic slowdown.’ Bloomberg News. 20 December 2021. bloomberg.com/news/articles/2021-12-20/chinese-banks-cut-borrowing-costs-for-first-time-in-20-months

[2] ‘Chinese banks cut borrowing costs as PBOC signals easing.’ Bloomberg News. 20 January 2022. bloomberg.com/news/articles/2022-01-20/chinese-banks-cut-borrowing-costs-again-on-pboc-easing-signals

[3] ‘China’s central bank takes modest easing path despite covid.’ Bloomberg News. 15 April 2022. bloomberg.com/news/articles/2022-04-15/china-s-central-bank-cuts-reserve-ratio-for-banks-to-spur-growth

[4] ‘China banks cut key rate by record to boost ailing economy.’ Bloomberg News. 20 May 2022. bloomberg.com/news/articles/2022-05-20/china-cuts-borrowing-costs-by-record-to-boost-loan-demand

[5] ‘China shocks with rate cut as data shows ‘alarming’ slowdown.’ Bloomberg News. 15 August 2022. bloomberg.com/news/articles/2022-08-15/china-central-bank-unexpectedly-cuts-key-rate-to-boost-growth.

[6] ‘China seeks to stabilise property crisis as PBOC urges lending.’ Bloomberg News. 22 August 2022. bloomberg.com/news/articles/2022-08-22/china-s-banks-trim-lending-rates-to-reverse-slump-in-borrowing

[7] ‘China plans $29 billion in special loans to troubled developers.’ Bloomberg News. 22 August 2022. bloomberg.com/news/articles/2022-08-22/china-plans-29-billion-in-special-loans-to-troubled-developers

[8] ‘China cuts forex reserve ratio in bid to support tumbling yuan.’ Bloomberg News. 5 September 2022. bloomberg.com/news/articles/2022-09-05/china-battles-yuan-losses-by-unleashing-foreign-exchange-onshore

[9] ‘China’s state banks cut deposit rates for the first time since 2015.’ Financial Times. 15 September 2022. ft.com/content/e9d7a148-a7af-400b-8ea3-a76c9607b188?emailId=5c0c3eae-12b0-4649-86a0-e0ed2e6a8474&segmentId=60a126e8-df3c-b524-c979-f90bde8a67cd

[10] The PBOC ordered that financial institutions selling foreign-exchange forward contracts be subject to a 20% risk-reserve ratio, up from zero. The change makes it costlier to sell yuan to buy dollars in the derivatives markets. See ‘China’s central bank moves further to bolster the yuan.’ The Wall Street Journal. 26 September 2022. wsj.com/articles/chinas-central-bank-moves-further-to-bolster-the-yuan-11664190159. ‘China’s offshore currency hits record low against dollar.’ The Wall Street Journal. wsj.com/articles/chinas-offshore-currency-hits-record-low-against-dollar-11664333671

[11] ‘China property shares rally on policy support.’ Financial Times. 3 October 2022. ft.com/content/0ffa4fb4-906f-4faa-8906-8a7e07852c92

[12] ‘These are China’s new measures to bolster economic growth.’ Bloomberg News. 25 August 2022. bloomberg.com/news/articles/2022-08-25/these-are-china-s-19-new-measures-to-bolster-economic-growth. See also ‘China’s stimulus: All the steps taken recently to boost the economy. Bloomberg News. 26 August 2022. bloomberg.com/news/articles/2022-08-26/china-s-stimulus-all-the-steps-taken-recently-to-boost-economy

[13] Bloomberg News. QuickTake. ‘What China’s three red lines mean for property firms.’ 9 October 2020. bloomberg.com/news/articles/2020-10-08/what-china-s-three-red-lines-mean-for-property-firms-quicktake

[14] Financial Times. ‘Evergrande misses deadline for $300bn debt restructuring plan.’ 31 July 2022. ft.com/content/01f8a2c7-4ed1-487b-aada-ac5e2b5a9932

[15] Bloomberg. ‘China’s home price slump reaches a year as crisis drags on.’ 16 September 2022. bloomberg.com/news/articles/2022-09-16/china-s-home-prices-fall-for-one-year-straight-as-crisis-deepens#xj4y7vzkg. The statistics are from the National Bureau of Statistics of China but its website is unsafe.

[16] ‘China’s Ponzi-like property market is eroding faith in the state.’ The Economist. 12 September 2022. economist.com/finance-and-economics/2022/09/12/chinas-ponzi-like-property-market-is-eroding-faith-in-the-state

[17] Daisuke Wakabayashi. ‘Homeowners boycott mortgage payments.’ The New York Times. 17 August 2022. nytimes.com/2022/08/17/business/china-economy-real-estate-crisis.html

[18] Bloomberg News. ‘China rolls out property policies across nation to fix slump.’ 14 September 2022. bloomberg.com/news/articles/2022-09-14/china-trickles-out-property-policies-across-nation-to-fix-slump. Bloomberg. ‘China’s home price slump reaches a year as crisis drags on.’ 16 September 2022. Op cit.

[19] Non-financial company debt stood at about 160% of GDP and household debt at about 60% in 2019.

[20] See ‘China’s debt bomb looks ready to explode.’ Nikkei Asia. 17 July 2022. asia.nikkei.com/Opinion/China-s-debt-bomb-looks-ready-to-explode

[21] See New Scientist. ‘Heatwave in China is the most severe ever recorded in the world.’ 23 August 2022. newscientist.com/article/2334921-heatwave-in-china-is-the-most-severe-ever-recorded-in-the-world/

[22] Bloomberg News. ‘Power crunch in Sichuan adds to industry’s woes in China.’ 21 August 2022. bloomberg.com/news/articles/2022-08-21/power-crunch-in-sichuan-adds-to-manufacturers-woes-in-china

[23] Ministry of Agriculture and Rural Affairs of the People’s Republic of China. ‘China urges intensified efforts to secure autumn harvests amid heatwaves.’ 23 August 2022. english.moa.gov.cn/news_522/202208/t20220823_300951.html. See also ‘China’s record drought is drying rivers and feeding its coal habit.’ The New York Times. 26 August 2022. nytimes.com/2022/08/26/business/economy/china-drought-economy-climate.html

[24] The World Bank in September warned the rate increases could trigger a “devastating” global recession. The World Bank. ‘Risk of global recession in 2023 rises amid simultaneous rate hikes.’ 15 September 2022. worldbank.org/en/news/press-release/2022/09/15/risk-of-global-recession-in-2023-rises-amid-simultaneous-rate-hikes

[25] ChinaDaily, a government-controlled English-language publication. ‘Lower living costs to boost birth rate.’ 19 January 2022. global.chinadaily.com.cn/a/202201/19/WS61e75124a310cdd39bc81e1b.html

[26] Cai Xia, professor at the Central Party School of the Chinese Communist Party from 1998 to 2012. ‘The weakness of Xi Jinping.’ Foreign Affairs. September/October 2022. foreignaffairs.com/china/xi-jinping-china-weakness-hubris-paranoia-threaten-future

[27] See ‘China reins in its Belt and Road Program, $1 trillion later.’ The Wall Street Journal. 26 September 2022. wsj.com/articles/china-belt-road-debt-11663961638

[28] See ‘War jitters. A weak China may be more warlike than a strong one.’ A review of the book ‘Danger zone: The coming conflict with China’ by Hal Brands and Michael Beckley. The Economist. 1 September 2022. economist.com/china/2022/09/01/a-weak-china-may-be-more-warlike-than-a-strong-one

[29] OECD. ‘Main science and technology indicators.’ September 2020. oecd.org/sti/msti.htm

[30] See Victoria Herczegh. ‘A confrontation China can’t afford.’ 27 July 2022. https://geopoliticalfutures.com/a-confrontation-china-cant-afford/

Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellangroup.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of a Magellan financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. Magellan makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Any third party trademarks contained herein are the property of their respective owners and Magellan claims no ownership in, nor any affiliation with, such trademarks. Any third party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan.